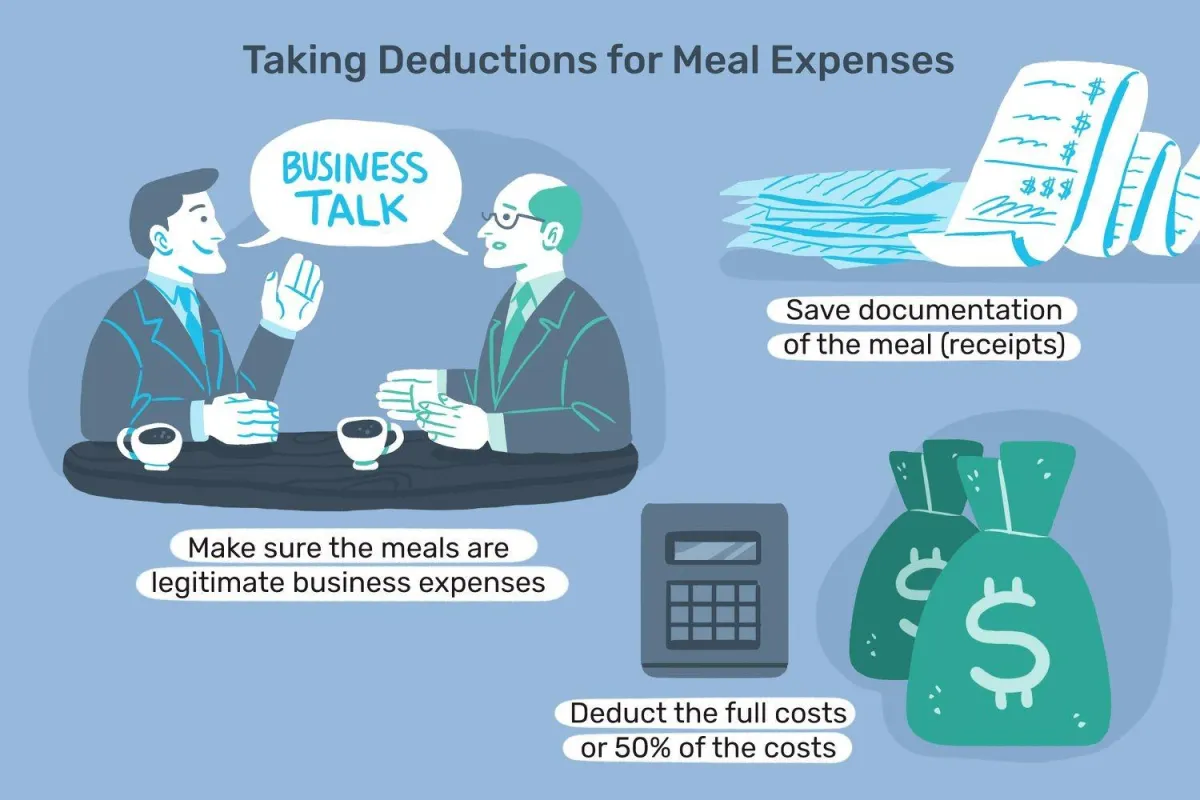

The Meal Categories Strategy for Tax Deductions

Written by Angelica Roxas

As a business owner, you should never have to pay more than necessary in taxes. This is why it is crucial that you learn about Tax Act & Jobs Act, gain more knowledge on how to properly plan your taxes, and look out for various strategies to ensure that you never overpay.

The Consolidated Appropriations Act, which was approved into law on 27th December, 2020, expressed the meal categories that can be deducted in taxes. This is a valid strategy you can use to legally avoid paying unnecessary taxes.

Going further in this post, we will be sharing with you the various categories of meals, and at what rate they can be deducted from your taxes, so stick around…

100% Deductible Meals

This is the category of meals that are totally deductible in taxes. See the list below:

Transport expenses to host a business dinner or leisure event can be totally deducted from taxes, based on the circumstances surrounding the event.

Meals that are served within the business premises if over half of the workforce obtains mealtimes for the company's expediency.

Publicly accessible promotional events

Social and recreational costs like Summer Picnics that is catered for by the business, to mainly benefit lower-paid workers.

Corporate gifts of about $25 to a single individual each tax year.

50% Deductions

When you host lunch time with a client or worker for business meetings.

Renting rooms for a cocktail party or dinner that is totally related to the business.

Any tips that are relevant to entertainment programs or meals.

Category with No Deductions

Events or meals with client or worker, that have no purpose with the business.

Sporting tickets that are not attended.

Fees paid at athletic clubs, country clubs, and so on.

Unreasonable spending on extravagant parties

Final Words

In this post, we have given you an insight into how you can leverage the Meal Category to optimize how you pay your taxes. However the processes can sometimes seem daunting, as it is not what you do every day. So you might consider using the services of a Tax Strategist. Don’t forget to download our eBook on “The Ultimate Guide to Tax Savings” for Real Estate Investors & Business Owners.

Tax Strategies for Business Owners

Written by Angelica Roxas on May 24th 2023

California businesses pay income taxes based on their structure and income.

Most pay a corporate tax of 8.84% on their net income from California sources. Some also payan alternative minimum tax of 6.65% to limit their deductions. Others pay a franchise tax basedon their net income. This includes S corporations, LLCs, LPs, and LLPs. The franchise tax rate is 1.5% for S corporations and 3.5% for S corporation banks and financials.

We are committed to providing our clients with reliable, accurate, and comprehensive taxation services that get the job done right. Our experienced accountants and tax strategists will work with you to understand your unique business needs and make sure that you are in full compliance with the law.

That said, tax planning can help businesses minimize their taxes. Here are some strategies to consider:

Project Your Business Tax

A tax projection is a great way to plan for upcoming taxes and ensure you're meeting your obligations. For example, if you anticipate that your income will be higher than usual, you can plan to pay additional taxes throughout the year so that you don’t get hit with a large bill when tax season arrives. You can also use a tax projection to identify areas where you may need additional deductions or credits to reduce your tax liability.

Take Advantage of Tax

Tax credits are dollar-for-dollar reductions of your tax liability, while deductions allow you to reduce the amount of income that is subject to tax. The IRS offers numerous credits for businesses in a variety of industries. These include renewable energy credits, low-income housing tax credits, research and development credit, employer-paid health insurance premiums credit, and child care expenses credits.

BLOG POSTS

Maximize Deductions & Minimize Liability as a South Bay Construction Business Owner

Are high taxes putting a dent in your construction business profits? South Bay's construction scene is......more

Maximize Deductions & Minimize Liability as a South Bay Construction Business Owner

Are high taxes putting a dent in your construction business profits? South Bay's construction scene is......more

Maximize Deductions & Minimize Liability as a South Bay Construction Business Owner

Are high taxes putting a dent in your construction business profits? South Bay's construction scene is......more

Common business tax deductions include business travel expenses, advertising costs, employee wages and salaries, rent or mortgage payments on your business premises, insurance premiums, legal fees, charitable donations, and other miscellaneous costs. Businesses can also elect to deduct business expenses in the year they are incurred or amortize them over a period of years.

Other Business Tax Planning Strategies in California

Beyond the deductions and credits, there are other tax planning strategies that businesses can use to reduce their taxes. These include:

We constantly strive to make sure our clients are informed about up-to-date changes in taxation laws and provide tailored tax planning services that will help maximize Tax savings.

No matter what your business size or industry is, South Bay Tax Solutions has the expertise to help you navigate the taxation process with ease.

Taking Advantage of section 179 Expensing : This allows businesses to deduct full cost of certain equipment, up to specified limit, in the same year that is purchased and put into use.

Investing in Qualified Small Business Stock: If stocks are acquired and held for at least 5 years, gains may be excluded from taxable income up to a certain amount.

Utilizing the Net Operating Loss Carryforward: If losses exceed current year income, they can be carried forward and offset against future years’ income to reduce taxes.

Choosing the Proper Legal Entity Structure: Different types of legal entities have different tax rates and filing requirements, so it’s important to choose the one that will provide the most tax savings.

Ultimately, the best way to save on taxes is to work with a qualified tax professional who can help you identify the strategies that are best suited for your situation.

Here at South Bay Tax Solutions, we have the expertise to help you maximize your tax savings so that you can save more money and keep more of what you earn. Contact us today to schedule your free consultation.

We look forward to helping you develop the best strategy for reducing your tax burden!

Resources & References :

Alternative Minimum Tax:

https://www.ftb.ca.gov/tax-pros/procedures/multistate-audit-technical-anual/chapter-8500.pdf